Author: FitVibesOnly

Hey, I’m FitVibesOnly—your new fitness BFF who’s all about breaking a sweat and having fun while doing it. Whether you’re here to crush your workout goals, find balance, or just figure out how to enjoy leg day (it’s possible, I promise!), you’re in the right place.This blog is all about real talk, no fluff. From workout tips to healthy recipes and mindset shifts, I’m here to make fitness less intimidating and way more empowering. Spoiler: It’s not about being perfect—it’s about showing up, smashing limits, and feeling like the strongest version of YOU.Let’s lace up, lift heavy, and laugh through the journey. Because fitness isn’t just a goal; it’s a vibe—and you’re gonna love it.

Voting is officially open for the TechRadar Choice Awards 2025, giving readers the chance to cast their ballots for the best fitness and home technology released in the past year. Your votes will contribute to crowning the most innovative and impactful products across a wide array of categories, with the deadline for submissions set for

Tech enthusiasts are invited to cast their votes in the TechRadar Choice Awards 2025, with polling officially open for the highly anticipated Fitness & Home Tech categories. Readers have until October 1st, 2025, to help crown the year’s most innovative and beloved gadgets in these rapidly evolving sectors. The annual TechRadar Choice Awards celebrate the

Voting is officially open for the TechRadar Choice Awards 2025, offering readers the chance to help crown the best innovations in the Fitness & Home Tech sectors. Enthusiasts can cast their votes across a wide array of categories, with the deadline set for 00:01 AM PST / 03:01 AM EST / 08:01 AM BST on

London, UK – The TechRadar Choice Awards 2025 are officially open for public voting, inviting readers to help crown the best in Fitness and Home Technology. Enthusiasts have until October 1, 2025, to cast their votes across a wide array of categories celebrating the most innovative and loved gadgets of the past year. Readers’ input,

As Prime Minister Narendra Modi celebrates his 75th birthday this September 17, 2025, his remarkable energy and sustained vigor continue to be a subject of public fascination and inspiration. Despite a demanding schedule that often extends for 16-18 hours daily, PM Modi maintains a high level of physical and mental fitness, attributed to a disciplined

Readers can now cast their votes for the TechRadar Choice Awards 2025 in the Fitness & Home Tech categories, helping to determine the year’s standout products. The voting period is underway, with a deadline of October 1, 2025, for submissions to be counted, and winners are slated to be announced starting October 20, 2025. Have

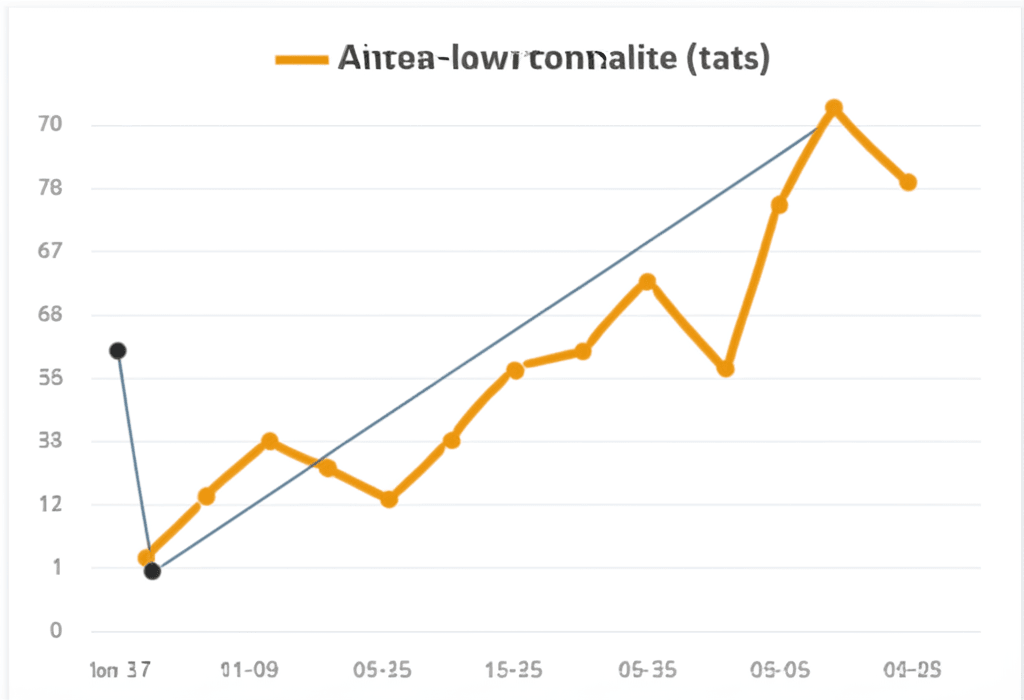

New Delhi, India – India’s fitness technology sector has seen a sharp decline in funding, attracting only $7 million in the year-to-date period of 2025. This figure, as per Tracxn’s India Fitness Tech Wrap Report 2025, signals a significant post-boom slowdown in investor activity, reflecting a cautious stance after a peak in 2021. The current

India’s fitness technology sector has recorded a significant slowdown in funding, raising only $7 million in the year-to-date period of 2025, according to Tracxn’s India Fitness Tech Wrap Report 2025. This figure reflects a sharp decline from its peak in 2021 and indicates a more cautious investment environment after a period of rapid growth. Historical

India’s burgeoning fitness technology sector has experienced a significant downturn in funding, securing only $7 million in the year-to-date period of 2025. This sharp decline, reflecting a notable shift from previous peaks, signals a more cautious investment landscape following a pandemic-driven boom, according to Tracxn’s India Fitness Tech Wrap Report 2025. Sharp Decline in Investment

New Delhi, India – India’s fitness technology sector has witnessed a significant deceleration in funding, raising only $7 million in the first nine months of 2025 (year-to-date), a stark contrast to its peak in 2021. This decline signals a more cautious investment landscape following a period of rapid growth, as investors adopt a measured approach